Managing financial transactions properly is one of the most critical aspects of accounting. Among the many questions businesses often ask, one important concern is: Can we allow expenses fixed assets in purchase vouchers?

To answer this clearly, we must first understand what fixed assets are, what expenses are, what purchase vouchers are, and how accounting systems treat them.

In this article, we will explore the topic in depth, breaking down everything from definitions to accounting standards, with practical examples.

Understanding Fixed Assets

Fixed assets are long-term tangible assets that a company owns and uses to generate income. These assets are not expected to be consumed or sold during the normal course of business operations within a year. Common examples include:

- Land and Buildings

- Machinery and Equipment

- Vehicles

- Office Furniture

Fixed assets are capitalized on the balance sheet and then depreciated over their useful life.

Key Features of Fixed Assets:

- Long-term use (more than one year)

- Not intended for sale

- Used for production or administrative purposes

- Depreciation applicable (except for land)

What Are Expenses?

Expenses are the costs incurred in the process of earning revenue. Unlike fixed assets, expenses provide immediate benefits and are fully charged to the profit and loss account within the same accounting period.

Common examples include:

- Rent

- Salaries and Wages

- Utilities

- Repairs and Maintenance

- Office Supplies

Expenses are considered short-term in nature and are critical for daily operations.

What Is a Purchase Voucher?

In accounting, a purchase voucher is a document or record that captures the details of a purchase transaction. It usually includes:

- Supplier’s Name

- Date of Purchase

- Items Purchased

- Amount Payable

- Payment Terms

In accounting systems like Tally, SAP, Oracle, or QuickBooks, purchase vouchers are used to record purchases, both for goods and services.

Purchase vouchers ensure that the purchases are correctly posted into the financial books, providing a clear trail for audits and reviews.

Can We Allow Expenses Fixed Assets in Purchase Vouchers?

Now, coming to the main question:

Can we allow expenses fixed assets in purchase vouchers?

The simple answer is: Yes, but with caution.

Let’s explore when and how it can be done.

1. Fixed Assets Purchased Can Be Recorded Through Purchase Vouchers

If you are purchasing a fixed asset like machinery, furniture, or a vehicle from a supplier, it is common practice to record this transaction using a purchase voucher. In this case, the purchase voucher acts as the initial point of entry for the asset into the company’s books.

In accounting entries:

- Debit: Fixed Asset Account (e.g., Machinery A/c)

- Credit: Supplier or Bank A/c

Thus, fixed assets can be recorded in purchase vouchers without any issue, provided that the correct ledger group (Fixed Assets) is selected while preparing the voucher.

2. Expenses Are Usually Not Recorded Through Purchase Vouchers

Regular operating expenses such as electricity bills, rent, or office supplies are generally recorded using expense vouchers or journal vouchers, not purchase vouchers.

Why? Because purchase vouchers are typically reserved for the procurement of goods and services that involve receiving an invoice from a supplier.

3. Expense Related to Asset Purchase Can Be Clubbed

Sometimes, certain expenses are directly related to the acquisition of a fixed asset, such as:

- Installation Charges

- Freight and Transportation Costs

- Import Duties

- Testing and Trial Run Costs

According to accounting standards (e.g., IAS 16), such costs are capitalized along with the fixed asset.

In this case, you can include these expenses in the purchase voucher of the fixed asset itself.

For example:

You purchase machinery for $10,000 and pay $500 for installation.

The voucher entry should be:

- Debit: Machinery A/c – $10,500

- Credit: Supplier/Bank A/c – $10,500

Thus, expenses directly attributable to the asset can be included and allowed in purchase vouchers.

Things to Keep in Mind

When recording expenses or fixed assets in purchase vouchers, you must observe the following:

a) Correct Ledger Selection

Make sure you are selecting the appropriate ledger:

- For Fixed Assets: Select ledger under “Fixed Assets” group.

- For Expenses: If truly necessary in a purchase voucher (rare), use “Indirect Expenses” group.

b) Follow Accounting Standards

Expenses that qualify for capitalization must be added to the cost of the fixed asset.

Unrelated expenses must be booked separately and not clubbed with the asset.

c) Maintain Clear Narrations

Every purchase voucher must have a clear narration that mentions whether it is a fixed asset purchase, expense, or a combination.

Example Narration:

“Purchase of Machinery along with installation charges as per Invoice No. 456 dated 01-Apr-2025.”

d) Differentiate Capital and Revenue Expenditure

Capital expenditures increase asset value and are long-term in nature, while revenue expenditures are consumed immediately. Mixing them incorrectly can misstate financial statements.

Common Mistakes to Avoid

- Wrong Ledger Grouping: Selecting “Purchase Account” instead of “Fixed Assets” for an asset purchase.

- Booking All Expenses as Fixed Assets: Only those directly attributable to the asset should be capitalized. Others should be expensed.

- Ignoring Depreciation Setup: After recording a fixed asset purchase, set up depreciation schedules properly.

- Poor Documentation: Not attaching supplier invoices, transportation bills, or installation receipts with vouchers.

Benefits of Proper Voucher Management

- Accurate financial reporting

- Easier auditing and compliance

- Correct tax treatment

- Improved decision-making based on true asset values

- Transparency in expense management

Properly allowing expenses fixed assets in purchase vouchers ensures that your company’s financial records are correct and audit-ready.

Practical Example: How to Enter in Accounting Software

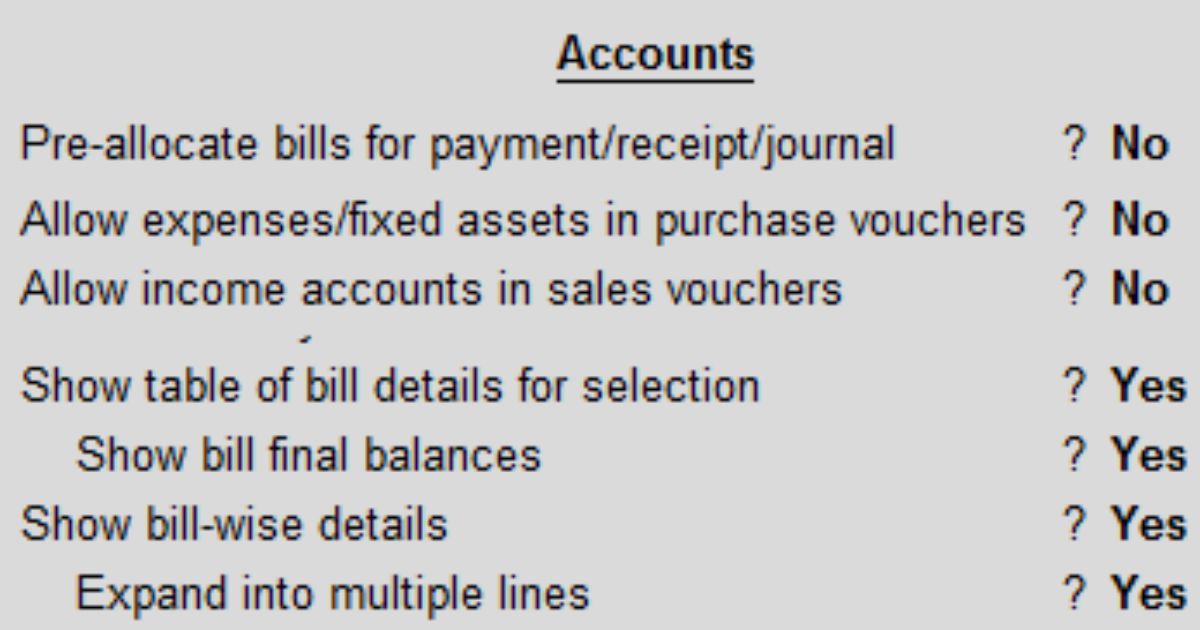

Let’s assume you are using Tally Prime. Here’s how you can enter:

- Go to Accounting Vouchers

- Select Purchase Voucher (F9)

- Select Party’s Account (Supplier)

- Under ‘Particulars’, select ‘Machinery’ ledger

- Enter Amount (Including Expenses if Capitalized)

- Provide Bill Reference and Narration

- Save

Similarly, in SAP or Oracle, use the appropriate purchase entry screen but ensure ledger grouping is correctly selected.

Final Conclusion

Can we allow expenses fixed assets in purchase vouchers?

Yes, you can — but only in specific cases and with careful handling.

- Fixed assets should be recorded through purchase vouchers.

- Directly related expenses can be capitalized with the asset value.

- Operating expenses generally should not be recorded in purchase vouchers.

- Always comply with accounting standards and maintain clear documentation.

Correctly managing your vouchers not only ensures accurate books but also saves you from future tax and audit complications. Whether you are a small business, a growing startup, or a large enterprise, understanding this principle is essential for sustainable financial management.

FAQs

Q1: Can office supplies be entered in purchase vouchers?

Yes, but they should be booked under an “Office Supplies” expense ledger, not under Fixed Assets.

Q2: Should installation charges be booked separately?

If installation charges are directly attributable to bringing a fixed asset to working condition, they should be capitalized with the asset.

Q3: Can we record repair expenses with fixed asset purchases?

No. Repairs and maintenance are considered revenue expenses and should be recorded separately, not capitalized.

Q4: Is it mandatory to use purchase vouchers for fixed assets?

It is the recommended and professional way to record fixed asset purchases for better traceability and audit trail.