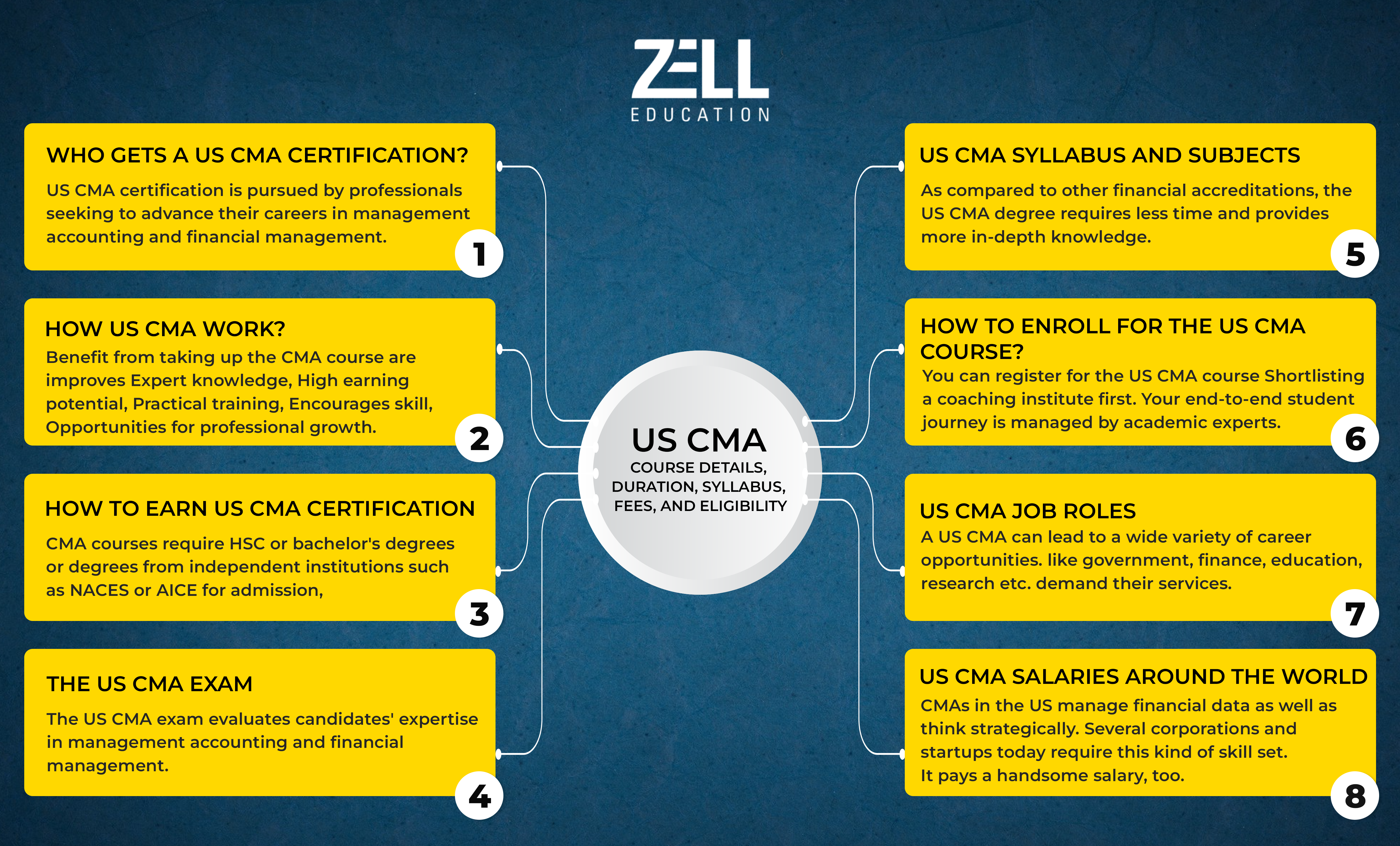

If you want to mix accounting skills with real business decisions, the CMA course gives you that mix. It suits both beginners and professionals who want to move beyond routine accounting. Let’s cover the CMA course details, layout, fees, and the kind of jobs that come with it.

CMA Full Form and What It Really Means

The CMA full form is Certified Management Accountant. The title comes from the Institute of Management Accountants (IMA), USA.

It’s not about tallying numbers. It’s about reading them, predicting what they’ll do next, and acting on that.

Freshers use it to start strong. Professionals use it to move up. Both win.

CMA Course Details That Actually Matter

Here’s what you need to know. No stories, just facts.

Eligibility

You need a bachelor’s degree or are pursuing one. Commerce or finance backgrounds fit fast, but it’s open for anyone who can handle numbers.

Duration

Most finish it in 6 to 12 months. Students can do it during college. Working people do it alongside their job.

Exam Format

Two parts.

- Part 1: Financial Planning, Performance, and Analytics

- Part 2: Strategic Financial Management

Each part: 100 multiple-choice questions + 2 essay questions.

Fees

Roughly USD 1,000–1,200 for students. A bit more for working professionals. Way cheaper than most global courses that charge double.

Pass Rate

Around 45–50%. Average means you need consistency, not genius.

That’s the raw version of CMA course details people actually ask for.

CMA Course Details for Freshers

If you’re still in college, you’re in the perfect zone. Doing CMA early saves years. You walk into your first job already trained to think beyond accounting.

Here’s what freshers get out of it:

- Learn how companies actually earn, spend, and grow.

- Learn to see numbers as business signals, not math homework.

- Land jobs faster because you already know what most graduates guess.

If you start during college, finish before graduation. By the time your degree ends, you’ll already have something that recruiters trust.

CMA Course Details for Working Professionals

You already have experience. Now you want growth. The CMA course details mean more here because it’s not just another line on your CV. It’s proof you can think at a management level.

Working professionals take CMA to switch from execution to decision-making. They know the numbers but want to lead the meetings. That’s the jump CMA gives.

Most study 8–10 hours a week, clear both parts in a year, and move to better titles like:

- Financial Analyst

- Cost Manager

- Finance Controller

- CFO in a few years if they keep pushing

It fits around your job, it pays off fast, and it builds real authority.

CMA Full Form and Why It Holds Weight

Let’s hit the CMA full form again – Certified Management Accountant.

The word that matters most is “Management.” It shifts you from counting to controlling.

Global firms value that mindset. They want people who know finance and can make decisions from it. Whether it’s manufacturing, IT, consulting, or startups, CMAs fit right in.

This certification speaks the same language across 100+ countries. It’s one of those titles that needs no translation.

How to Study Smart for CMA

People fail this exam not because it’s hard but because they treat it like college. It’s not.

Here’s what works:

- Study in short daily bursts instead of long weekend marathons.

- Focus on understanding logic behind every formula.

- Do mock tests every two weeks.

- Don’t skip essays. They train your brain to think like management.

- Build a steady rhythm – that’s what gets you through both parts.

CMA rewards clear thinking. Not cramming.

Career Growth After CMA

Once certified, you’re not stuck in one role. You can jump from accounting to finance, analysis, or leadership.

Freshers land finance roles paying around INR 6–8 LPA in India. After a few years, professionals make INR 15–25 LPA and sometimes more if they shift abroad.

Companies like Deloitte, PwC, EY, Accenture, Amazon, and many Indian firms hire CMAs constantly. They want people who understand business numbers and can act fast.

Common CMA Questions

Do I need a degree first?

No. You can register while studying. Just finish your degree within seven years to get certified.

Is CMA better than CPA or ACCA?

They’re not the same game. CMA trains you for business decisions, CPA sticks to public accounting, and ACCA handles global regulations. Pick what matches your direction.

How tough is CMA?

It’s disciplined, not tough. If you stay consistent, you clear it.

Does CMA have scope in India?

Yes. Multinationals and large Indian firms look for CMA-certified professionals constantly.

Final Thought

CMA isn’t theory. It’s business logic taught in a structured way. It makes you think sharper, act faster, and make better financial calls.

If you’re ready to get started, look at Zell Education. They coach students and working people to clear CMA through real-world learning, not boring theory.